Nvidia Expands AI Dominance with Groq Licensing Deal After Startup's $750 Million Funding Round

Nvidia Secures Groq Licensing Deal Amidst Valuation Surge

The artificial intelligence landscape saw a significant consolidation move as chip behemoth Nvidia announced a licensing deal with AI startup Groq. This development follows Groq's massive funding success in September, where it raised $750 million, pushing its valuation to $6.9 billion.

Startup Valuation More Than Doubles in One Month

The $750 million funding round was a pivotal moment for Groq, an AI hardware and software company. The capital injection resulted in the startup more than doubling its valuation in a short period. Prior to the September funding, Groq was valued at $2.8 billion in August of last year. The new $6.9 billion valuation underscores the intense investor appetite for companies developing next-generation AI infrastructure.

The substantial investment underscores the potential and market demand for advanced AI solutions.

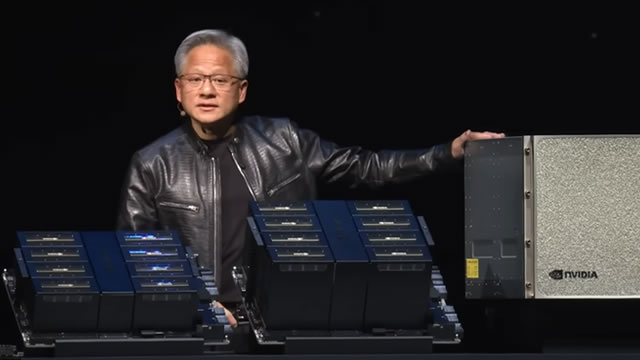

Nvidia’s move to license Groq’s technology and, notably, poach some of its top executives, highlights the competitive nature of the AI market. As the dominant player in AI hardware, Nvidia is strategically leveraging its market position to absorb promising technologies and talent that could pose future competition or enhance its existing offerings.

Market Implications and Sector Consolidation

The deal is seen by analysts as a further step in the consolidation of the AI sector, with Nvidia (NVDA) continuing to expand its influence beyond its core GPU business. Licensing deals and talent acquisition are key strategies for maintaining market leadership in a rapidly evolving technological field. The integration of Groq’s technology could potentially bolster Nvidia’s software stack or provide specialized capabilities for its hardware ecosystem.

The rapid increase in Groq’s valuation—from $2.8 billion to $6.9 billion—reflects a broader trend of high-stakes investment in AI startups, particularly those focused on optimizing model performance and deployment. This trend is driven by the increasing demand for computational power across various industries, from large language models to autonomous systems.

- Funding Catalyst: Groq secured $750 million in funding in September.

- Valuation Jump: The startup's valuation soared to $6.9 billion, up from $2.8 billion in August.

- Strategic Move: Nvidia's licensing deal and executive hires aim to integrate Groq's technology and talent.

The financial markets continue to watch how Nvidia integrates these new assets and how the move affects the competitive landscape for AI accelerators and software platforms.