Nvidia Agrees to Acquire AI Chip Challenger Groq for $20 Billion Cash in Record Deal

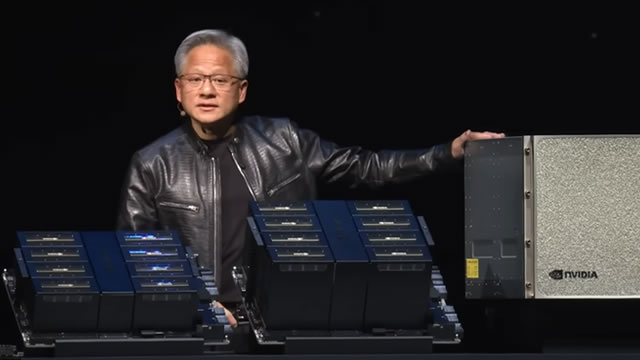

Nvidia Secures Groq in $20 Billion AI Accelerator Deal

Nvidia Corporation has reportedly agreed to acquire AI chip startup Groq for a staggering $20 billion in cash, according to reports citing CNBC on December 24, 2025. The acquisition of the designer of high-performance artificial intelligence accelerator chips marks one of the largest deals in the technology sector and is poised to be Nvidia's biggest purchase to date.

The move signals Nvidia's commitment to maintaining and expanding its market leadership in the crucial AI hardware segment. Groq specializes in developing chips designed to accelerate AI workloads, offering a potential competitive edge that Nvidia aims to integrate into its already dominant ecosystem.

Strategic Rationale and Market Dominance

The artificial intelligence market is experiencing explosive growth, driving unprecedented demand for specialized hardware capable of handling complex machine learning models. Nvidia, already the undisputed leader in AI chip manufacturing with its popular GPU architecture, faces increasing competition from both established players and innovative startups like Groq.

The acquisition of Groq is a strategic maneuver designed to:

- Bolster Technological Capabilities: Integrate Groq's specialized AI accelerator technology, potentially enhancing the performance and efficiency of Nvidia's future offerings.

- Neutralize Competition: Remove a potential challenger in the high-performance AI chip space.

- Solidify Market Position: Further entrench Nvidia's dominance in the AI infrastructure supply chain, which is critical for cloud providers and enterprise AI adoption.

“Nvidia is buying Groq for $20 billion in cash, according to a report from CNBC. The purchase is expected to be Nvidia's largest ever, and with Groq on its side, Nvidia is poised to become even more dominant in chip manufacturing.”

Financial and Sector Implications

The $20 billion all-cash price tag highlights the intense valuation pressure and strategic importance placed on companies developing next-generation AI hardware. This valuation reflects the perceived value of Groq's intellectual property and engineering talent in a market where performance gains translate directly into competitive advantage.

The deal comes as the broader semiconductor sector sees massive investment in AI infrastructure. Competitors like Broadcom are also making significant strides, evidenced by an AI order backlog of $73 billion projected over the next six quarters. This competitive backdrop underscores why Nvidia is willing to pay a premium to secure key technologies and talent.

The transaction is expected to face regulatory scrutiny given Nvidia's already substantial market share in the AI chip space. However, if approved, the integration of Groq's technology is anticipated to accelerate Nvidia's development timeline for advanced AI technologies, potentially impacting the competitive dynamics for years to come.

Forward Outlook

While the immediate market reaction to the news, reported just ahead of the Christmas break, may be muted, the long-term implications for the AI sector are significant. The combined entity will possess an even broader portfolio of AI computing solutions, ranging from training large language models (LLMs) to high-speed inference at the edge.

Investors will be watching for official confirmation from NVIDIA Corporation and details regarding the timeline for closing the deal and the planned integration of Groq's operations. The acquisition reinforces the narrative that the race for AI supremacy is fundamentally a race for superior hardware, with Nvidia continuing to deploy its considerable financial resources to stay ahead.