Medtronic Files for MiniMed Diabetes Business IPO, Retaining Over 80% Voting Control

Medtronic Moves to Partially Spin Off Diabetes Unit MiniMed

Medtronic plc has formally filed a registration statement for an Initial Public Offering (IPO) of its Diabetes business, MiniMed Group, signaling a significant strategic shift for the medical device manufacturer. The filing, announced on Friday, December 19, 2025, is part of a broader initiative by Medtronic to focus its resources and unlock value in specialized segments.

The most material detail of the filing is Medtronic's intention to maintain substantial control over the newly public entity. The company confirmed it will retain ownership of at least 80.1% of MiniMed's voting stock once the IPO is finalized. This structure suggests that while Medtronic is seeking to monetize and potentially increase the operational focus of the diabetes unit, it is not fully divesting the critical division.

Strategic Rationale and Financial Context

The decision to pursue a partial spin-off of MiniMed aligns with a trend among large diversified healthcare companies to separate slower-growth or non-core businesses to enhance shareholder value. For Medtronic, the move allows the Diabetes unit to operate with greater autonomy while still benefiting from the parent company's scale and resources.

Despite the positive strategic development surrounding the IPO, Medtronic's stock price (MDT) has recently experienced a slight decline. This market reaction comes even as the company reported strong underlying financial metrics, including a 7.9% increase in adjusted earnings per share. Analysts suggest the mixed stock performance may reflect broader market uncertainty or varied investor interpretations of the company's overall financial health and restructuring pace.

Focus on Innovation and Core Growth

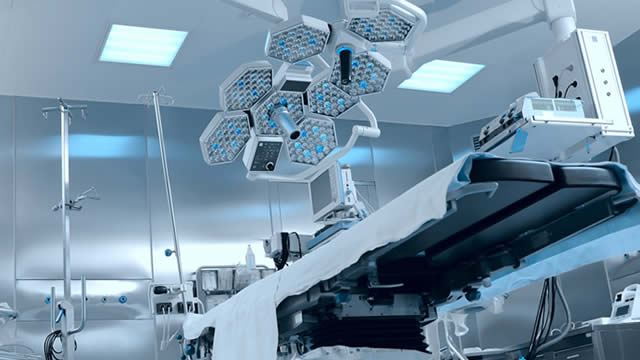

Medtronic's management has emphasized that the restructuring is intended to sharpen the focus on high-growth areas, including its innovative surgical technologies. The company continues to highlight advancements in its Hugo robotic-assisted surgery system, which represents a key growth driver in the competitive surgical robotics market.

The partial spin-off of MiniMed, a leader in insulin pumps and continuous glucose monitoring (CGM) systems, is designed to allow the unit to better compete in the rapidly evolving diabetes technology sector. By retaining a majority stake, Medtronic ensures it can still guide the long-term strategy and benefit from MiniMed's future growth and technological innovation.

Medtronic is making significant moves with the filing for an IPO of its Diabetes business, MiniMed, while also experiencing a slight decline in stock price.

Market Implications and Forward View

The IPO of MiniMed is expected to draw significant investor interest, given the high-growth potential of the diabetes care market. However, the structure—where Medtronic retains over four-fifths of the voting power—means that the parent company will continue to consolidate MiniMed's financials and maintain ultimate decision-making authority.

The successful execution of the IPO will be a key indicator of Medtronic's ability to execute its streamlining strategy. Investors will be watching closely to see if the partial spin-off can successfully unlock the perceived value of the Diabetes business without sacrificing the operational synergies currently enjoyed under the Medtronic umbrella.