LyondellBasell Q3 Results Show Double-Digit Declines as Net Debt/EBITDA Rises to 3.6x, Fueling Skepticism Over Near-13% Dividend Yield

LyondellBasell Industries (LYB) is facing intense scrutiny from investors after reporting a challenging third quarter marked by broad financial deterioration and a significant increase in leverage. The company’s key metric for financial health, net debt-to-EBITDA, has climbed to a concerning 3.6x, fueling market skepticism over the sustainability of its high dividend, which currently yields nearly 13%.

Q3 Performance Hit by Double-Digit Declines

The chemical manufacturer’s Q3 results were weak across the board, showing double-digit declines in both sales and earnings per share (EPS) compared to the previous year. This poor performance was not isolated to a single division; all five of LYB's operating segments posted weaker results during the period.

In addition to the operational slowdown, the company was forced to recognize significant impairment charges, further weighing down the quarterly bottom line. The combination of declining revenue, falling profitability, and non-cash charges paints a difficult picture for the near-term outlook.

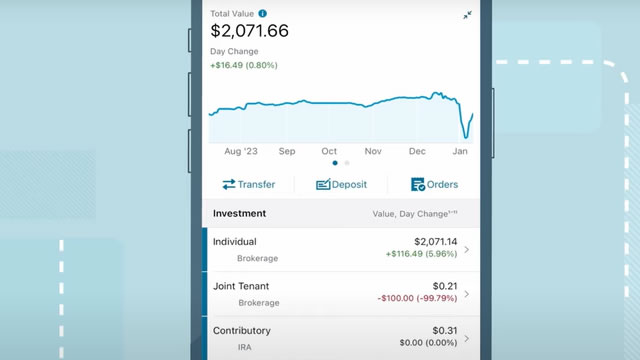

The market seems skeptical of the near 13% yield, which signals elevated risk due to deteriorating financials and segment declines.

Rising Leverage Heightens Dividend Risk

The most pressing concern for investors revolves around the company's balance sheet and its commitment to the substantial dividend payout. While management has publicly affirmed its commitment to the dividend, the financial metrics suggest the payout is under pressure.

The stock’s current yield, hovering near 13%, is often interpreted by the market not as a sign of deep value, but rather as an indicator of elevated risk concerning the dividend’s future viability. This high yield reflects investor doubt that the company can maintain the payout given its weakening cash flow generation.

The increase in leverage is a primary driver of this caution. The ratio of net debt to EBITDA, a crucial measure of a company’s ability to service its debt using operating earnings, has risen substantially to 3.6x. This rising leverage profile suggests that the company’s debt burden is growing relative to its earnings power, making it more vulnerable to economic downturns and increasing the cost of capital.

Sector Implications and Forward View

The struggles at LyondellBasell reflect broader challenges within the chemical sector, which has contended with fluctuating commodity prices, oversupply, and softening industrial demand. However, LYB’s specific increase in leverage and widespread segment weakness suggest company-specific issues are amplifying the cyclical pressures.

Investors will be closely monitoring management’s strategy for deleveraging and improving operational efficiency in the coming quarters. Until the company can demonstrate a clear path to reducing its net debt/EBITDA ratio below the current 3.6x and stabilize its earnings, the market is likely to remain highly cautious, keeping the stock price depressed and the dividend yield at risk-signaling levels.