TrustCo Bank Corp NY Launches New 2 Million Share Repurchase Program, Representing 11% of Outstanding Stock

TrustCo Bank Corp NY Authorizes Significant Share Buyback

TrustCo Bank Corp NY (Nasdaq: TRST) announced on December 19, 2025, that its Board of Directors has approved a new stock repurchase program authorizing the company to buy back up to 2,000,000 shares of its common stock. This figure represents approximately 11% of the bank holding company’s currently outstanding shares, signaling a strong commitment to returning capital to shareholders.

The announcement follows the completion of a previously authorized one-million share repurchase program earlier in December. The new program provides management with flexibility to execute the buyback through various methods, including open market or private transactions, block trades, or pursuant to a Rule 10b5-1 trading plan adopted in accordance with Securities and Exchange Commission (SEC) regulations.

Stock Performance Context

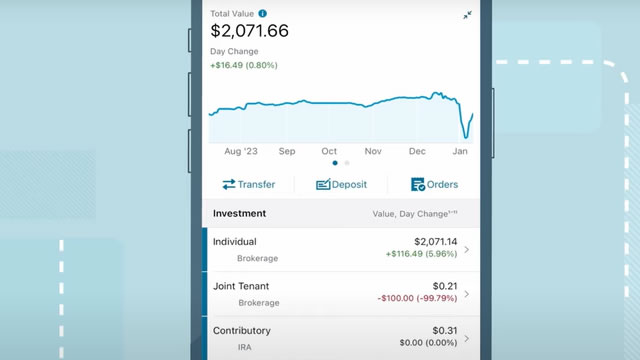

The decision to initiate a substantial share repurchase program is underpinned by the stock’s robust historical performance. Over the two years preceding the announcement, TRST delivered a total return of 53.86%, translating to an annualized return and Compound Annual Growth Rate (CAGR) of 24.04%. The stock has demonstrated relatively low volatility relative to its returns, evidenced by a two-year Sharpe Ratio of 5.21.

Recent trading activity shows the stock closing at $43.30, opening at $43.12. This is near the high end of its two-year trading range, where the highest close price was $44.85 and the lowest was $24.04. The average close price over the past two years stood at $31.32, with a standard deviation of 4.61, suggesting the stock has been trending upward with manageable price fluctuations.

Mechanism and Market Impact

Stock repurchase programs, often seen as a method of capital allocation, typically reduce the number of outstanding shares, which can boost earnings per share (EPS) and potentially support the stock price. For TrustCo, the repurchase of 11% of its outstanding shares is a material event that could significantly impact its per-share metrics.

The company, based in Glenville, N.Y., has opted for a flexible approach to the execution of the program, allowing it to take advantage of market conditions. Utilizing Rule 10b5-1 plans allows the company to execute trades during periods when it might otherwise be restricted due to insider trading rules, ensuring a systematic approach to the buyback.

The approval of a 2,000,000 share buyback, immediately following the completion of a prior program, underscores management's confidence in the company's valuation and future cash flow generation capabilities. This aggressive capital return strategy is likely to be viewed favorably by investors focused on shareholder yield.

Forward-Looking Implications

The maximum drawdown for TRST over the last two years was 0.54%, indicating strong price resilience. While the share repurchase is a positive signal, investors will monitor the execution pace and the resulting impact on the bank's balance sheet and regulatory capital ratios. The program's size suggests a sustained effort to optimize the capital structure and enhance shareholder value, building on the momentum of the strong 24.04% annualized return achieved over the measurement period.