Trump Media to Merge with Nuclear Fusion Firm TAE Technologies in $6 Billion All-Stock Deal

Trump Media Pivots to Fusion Energy with $6 Billion TAE Merger

Trump Media & Technology Group (DJT), the operator of the Truth Social platform, is set to merge with nuclear fusion company TAE Technologies in an all-stock transaction valued at more than $6 billion. The deal, announced recently, represents a significant strategic shift for the social media company, aiming to create the world's first publicly traded fusion power company.

The merger is anticipated to close in mid-2026, pending regulatory and shareholder approvals. Upon completion, the shareholders of both DJT and TAE Technologies are expected to own roughly 50% each of the combined entity.

Financial Context and Market Performance of DJT

The announcement comes amid scrutiny of DJT's recent stock performance. Over the past two years, the stock has delivered a total return of -16.66%, translating to an annualized return and Compound Annual Growth Rate (CAGR) of -8.71%. The risk-adjusted return profile, measured by the Sharpe ratio, stands at -0.77, indicating poor compensation for the risk taken by investors during that period.

Key financial metrics for DJT over the last two years include:

- Average Close Price: $27.23

- Highest Close Price: $66.22

- Latest Close Price: $14.86

- Standard Deviation of Close Price: 11.34

- Total Volume Traded: 5.7 billion shares (5,705,271,425)

Despite the negative historical returns, the merger is seen by some analysts as potentially beneficial for Trump Media, providing access to the high-growth, high-potential sector of nuclear fusion energy.

The Future of Fusion Power

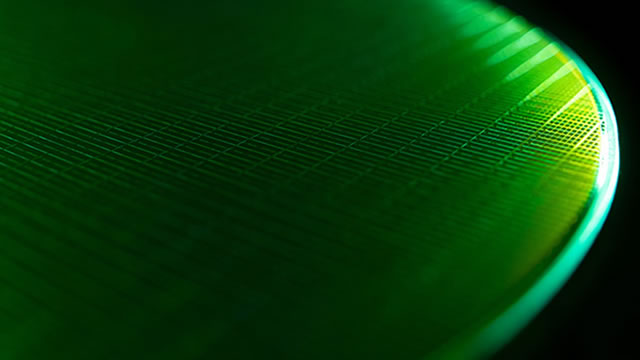

TAE Technologies, a leading nuclear energy startup, plans to begin building a reactor next year. Nuclear fusion, the process that powers the sun, promises a clean, virtually limitless energy source, attracting substantial investment and attention from the technology and energy sectors.

The combined company will leverage the public market access provided by DJT to fund TAE’s ambitious development timeline. The creation of the first publicly traded fusion power company is a landmark event for the nascent industry, potentially opening up new avenues for capital formation and public investment in clean energy technology.

Yahoo Finance energy reporter Jake Conley noted that the deal could probably benefit Trump Media the most, suggesting the move is a strategic attempt to diversify and capitalize on the high valuation potential of the fusion sector.

Sector Implications and Forward Guidance

The merger signals a growing trend of non-traditional companies seeking to enter the deep-tech and clean energy space, often through mergers with publicly listed entities. The $6 billion valuation underscores the perceived long-term value of fusion technology, even though commercial viability remains years away.

The expected closing date of mid-2026 aligns with TAE Technologies' development roadmap, suggesting that the capital infusion from the merger is intended to support the next phase of reactor construction and testing. Investors will be closely monitoring the progress of TAE's reactor development, as the success of the combined entity hinges heavily on achieving technological milestones in the highly complex field of nuclear fusion.