Sun Peak Metals Completes $6.7 Million Acquisition of Saudi Discovery, Targeting Arabian Nubian Shield Exploration

Sun Peak Metals Finalizes Saudi Discovery Acquisition

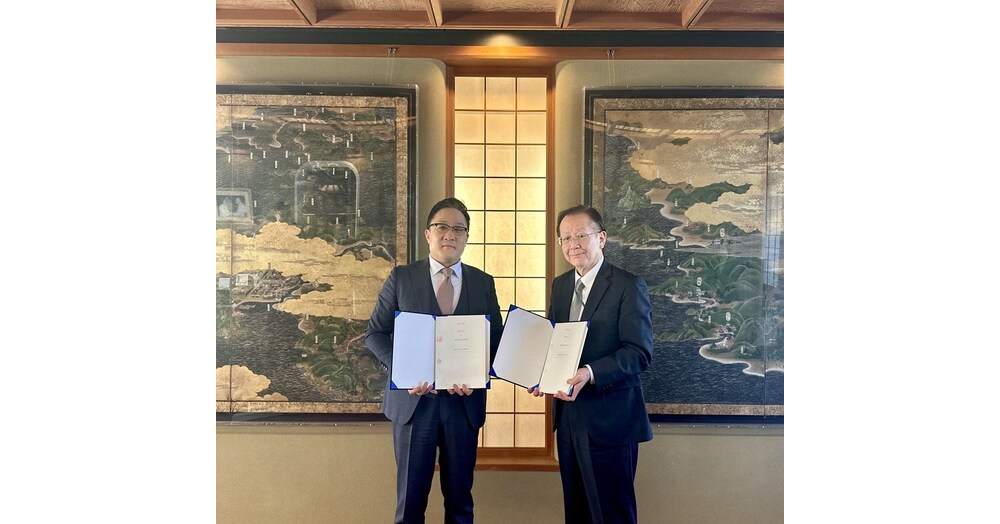

Sun Peak Metals Corp. (TSXV:PEAK), which also trades under the symbol SUNPF on the OTCQB, announced on December 18, 2025, the successful completion of its previously announced acquisition of Saudi Discovery Company SPV Limited (SDC). The transaction involved a share exchange for all issued and outstanding shares of SDC, positioning Sun Peak as a major exploration entity in the strategically important Arabian Nubian Shield.

The acquisition was completed alongside a related financing effort valued at $6.7 million. This capital injection and the integration of SDC’s assets are expected to significantly bolster Sun Peak’s operational footprint in the region.

Management Highlights Strategic Importance

The company’s leadership emphasized the transformative nature of the deal. Greg Davis, Chief Executive Officer of Sun Peak, commented on the strategic rationale behind the move:

“We are very excited to complete the transaction with SDC and related $6.7 million financing, which will make Sun Peak the marquee exploration company in the Arabian Nubian Shield.”

The Arabian Nubian Shield is a highly prospective geological formation known for its mineral wealth, and the acquisition signals Sun Peak’s commitment to expanding its exploration activities within this area.

Market Performance and Financial Metrics for PEAK.V

The completion of the acquisition comes as PEAK.V demonstrates strong performance metrics over the preceding two years. The stock’s latest close price was 0.36, slightly up from the latest open price of 0.35. Key financial indicators highlight significant shareholder value creation:

- The Total Return over the two-year period reached 89.47%.

- The Annualized Return and Compound Annual Growth Rate (CAGR) both stood at 37.65%.

- The stock exhibited a high risk-adjusted return, with a Sharpe Ratio of 400.32.

Historical Trading Context

While the stock has shown strong returns, its trading history indicates volatility. Over the past two years, the highest close price recorded was 0.62, contrasting with a lowest close price of 0.15. The average close price during this period was 0.33, with a standard deviation of 0.09. The maximum drawdown experienced was 60.72%, suggesting that while returns have been high, investors have faced periods of significant price decline.

The total volume traded over the two-year period was 14,531,093. The successful integration of SDC and the deployment of the $6.7 million financing are expected to be critical factors influencing investor sentiment and the stock’s trajectory moving forward, potentially stabilizing performance and capitalizing on the high returns generated prior to the transaction.