Micron Stock Soars Over 10% on Massive Earnings Beat, Driven by Sold-Out HBM Capacity and 'Unprecedented' AI Demand

Memory chip giant Micron Technology (MU) delivered a powerful financial update that sent its stock soaring more than 10% on Thursday, providing a much-needed boost to the broader artificial intelligence (AI) sector. The company posted non-GAAP earnings of $4.78 per share for the quarter ended November 27, a figure that comfortably surpassed the average analyst estimate of $3.94.

AI Accelerator Demand Fuels Massive Earnings Beat

The substantial earnings beat was immediately attributed to surging, 'unprecedented' AI-fueled demand for advanced memory chips. Micron’s results were so strong that some market observers characterized the performance as one of the biggest beats in the U.S. semiconductor industry in recent history.

Prior to the report, Wall Street had already set high expectations, with consensus estimates predicting revenue of $12.9 billion—a projected 48% year-over-year increase—and adjusted earnings more than doubling to $3.94 per share. Micron’s actual performance significantly exceeded these lofty forecasts, validating analyst optimism that had recently led to multiple price target increases to $300 per share or higher.

High-Bandwidth Memory (HBM) Capacity Sold Out Through 2026

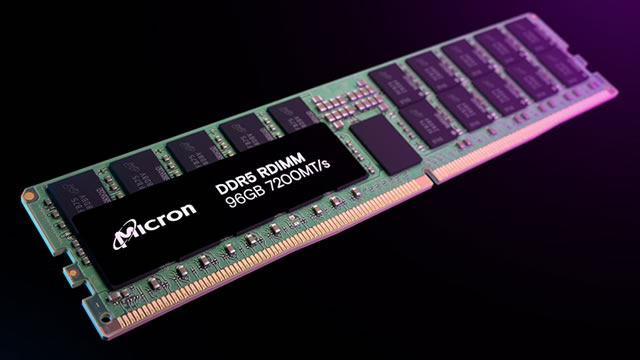

The primary driver of Micron’s financial strength is its strategic exposure to High-Bandwidth Memory (HBM), a specialized component essential for powering AI accelerators and large language models. The demand for these high-value components is so intense that Micron has already sold out its entire HBM capacity for 2025 and most of 2026.

This forward-looking guidance signals a sustained period of premium pricing and margin expansion for the memory chipmaker. Analysts project that this shift toward higher-value AI and enterprise opportunities will drive margin expansion toward 60%, aligning with projections for continued bit growth in advanced nodes, such as one-gamma DRAM.

- Non-GAAP EPS: $4.78 per share (Actual) vs. $3.94 per share (Estimate)

- Stock Reaction: Shares of MU soared more than 10% on the news.

- Forward Guidance: HBM capacity is sold out for 2025 and most of 2026.

Market Impact and Sector Momentum

The strong results from Micron offered a significant glimmer of hope for technology investors, particularly those focused on AI stocks, which had experienced weeks of disappointing performance. The surge in MU stock helped lift the broader sector, demonstrating that robust, AI-driven growth remains a powerful force in the market.

Micron’s ability to reallocate its capacity to higher-value AI opportunities is a key factor in its improved financial trajectory. The company’s focus on advanced memory solutions, critical for complex AI workloads, positions it favorably against competitors as the industry transitions to more sophisticated computing architectures.

The unprecedented demand for AI accelerators is allowing Micron to command premium pricing and expand margins, confirming the long-term viability of the memory market recovery.

Over the past two years, Micron has demonstrated exceptional market resilience, achieving a total return of 205.06% and an annualized return (CAGR) of 74.66%. The latest earnings report confirms that the company is successfully leveraging the AI boom to accelerate its growth trajectory, moving past previous cyclical downturns in the memory market.