Merck's Strong Q3 Earnings and Deep Pipeline Drive Price Target Hike to $114

Merck Beats Q3 Estimates, Focus Shifts to Pipeline Strength

Pharmaceutical heavyweight Merck & Co. (MRK) delivered strong third-quarter results, reporting non-GAAP earnings per share (EPS) of $2.58, comfortably surpassing the consensus analyst estimate of $2.35. The company also posted robust quarterly revenue of $17.3 billion, driven by continued demand for its flagship oncology and vaccine products.

Key Drivers: Keytruda and Gardasil Performance

The strong financial performance in Q3 2024 was primarily attributed to the sustained momentum of its two key products: the blockbuster cancer immunotherapy Keytruda and the human papillomavirus (HPV) vaccine Gardasil. Furthermore, the company's focus on disciplined cost management contributed positively to the bottom line, helping to widen the margin beat.

Merck is reiterated as a buy, with the price target raised to $114, reflecting robust Q3 results and strong technical momentum.

Following the earnings release and analysis of the company's forward strategy, the price target for MRK was raised to $114. This upward revision reflects confidence in the company's operational execution and its ability to navigate future challenges.

Mitigating the Patent Cliff Risk

A central theme in the investment thesis for Merck is its strategy to manage the looming patent expiration for Keytruda, one of the world's best-selling drugs. Analysts point to the company's extensive development pipeline as the primary engine for future growth, positioning MRK to thrive beyond the expected patent cliff.

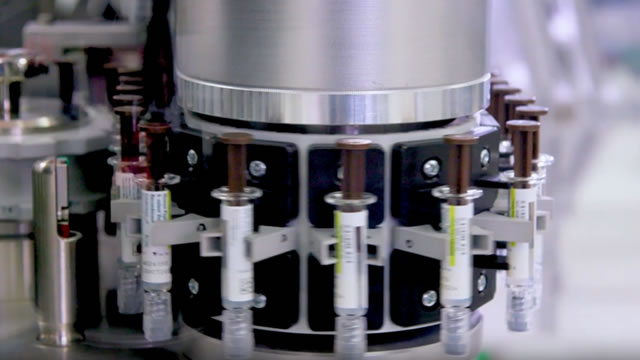

- 80 Phase III Trials: Merck currently has approximately 80 compounds or indications in Phase III clinical trials, representing a significant breadth of potential future revenue streams across various therapeutic areas.

- Strategic Acquisitions: The recent acquisition of Verona Pharma is highlighted as a move to bolster the pipeline, particularly in respiratory and pulmonary diseases, diversifying the company's reliance away from oncology.

The combination of strong Q3 cash flow generation and a deep, diversified pipeline supports the bullish outlook for MRK. The company's ability to consistently beat earnings expectations while strategically investing in future assets suggests a strong foundation for long-term value creation in the pharmaceutical sector.