Kyverna Therapeutics Secures $225 Million in Financing, Extending Cash Runway into 2027 for Autoimmune CAR T Pipeline

Kyverna Bolsters Balance Sheet to Accelerate Autoimmune Cell Therapy Development

Kyverna Therapeutics (KYTX) has secured a substantial financial injection, combining a $100 million public offering with an untapped $125 million loan facility, a move that is projected to extend the company's cash runway into 2027. This strengthened financial position is critical for the clinical-stage biopharmaceutical firm as it seeks to accelerate the development of its innovative CAR T-cell therapies aimed at treating severe autoimmune diseases.

The successful capital raise provides Kyverna with the necessary resources to continue pipeline progress, particularly for its lead candidate, mivocabtagene autoleucel (KYV-101). This therapy is central to Kyverna’s mission of harnessing T cells to reset the immune system, potentially achieving treatment-free remission for patients suffering from debilitating conditions.

Mivocabtagene Autoleucel Shows Promise in Phase 2 Data

The financial backing arrives as Kyverna’s mivocabtagene autoleucel demonstrates encouraging results in clinical trials. Phase 2 data for the candidate, which is being evaluated in multiple autoimmune indications, has shown both strong efficacy and a favorable safety profile. These results are crucial for supporting the late-stage advancement of the therapy.

KYV-101 is a novel CD19-targeting CAR T-cell therapy designed to selectively deplete B cells, which are key drivers of many autoimmune disorders. By targeting these cells, the therapy aims to fundamentally reset the immune system, offering a potentially curative approach that goes beyond standard immunosuppressive treatments.

- Financial Strength: The $100 million public offering provides immediate capital, while the $125 million loan facility offers significant financial flexibility for future needs.

- Extended Runway: The combined financing extends the company’s cash runway into 2027, mitigating near-term funding risks associated with costly clinical trials.

- Clinical Progress: Funds will support ongoing and future clinical trials, including the Phase 2 study of KYV-101 in conditions such as myasthenia gravis.

Market Reaction and Commercial Outlook

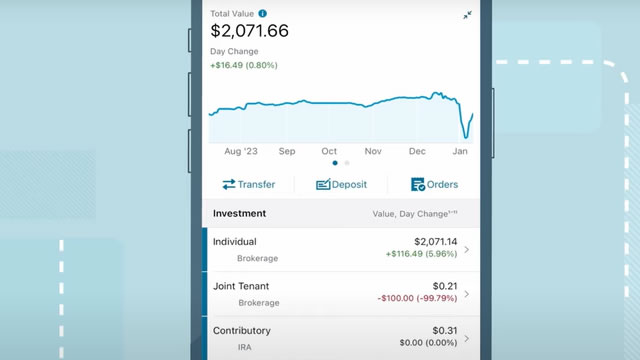

The significant financial strengthening has been met positively by the market, with some analysts upgrading their outlook on the stock. The extended cash runway de-risks the company’s operations and provides a clear path toward key clinical milestones without the immediate pressure of seeking further dilution.

The successful execution of the financing strategy positions Kyverna to maintain its aggressive development timeline. Based on the current trajectory and promising Phase 2 results, the company is targeting a potential commercial launch of mivocabtagene autoleucel by the end of 2026. This timeline places Kyverna at the forefront of the emerging field of CAR T-cell therapies for autoimmune diseases, a sector that holds immense promise for patients who have exhausted conventional treatment options.

The shift of CAR T technology—originally developed for oncology—into the autoimmune space represents a major paradigm shift in medicine. Kyverna’s focus on achieving deep, durable responses leading to treatment-free remission is highly valued by clinicians and investors alike. The substantial capital raised ensures that Kyverna can fully fund the necessary late-stage trials required to bring this potentially transformative therapy to market.